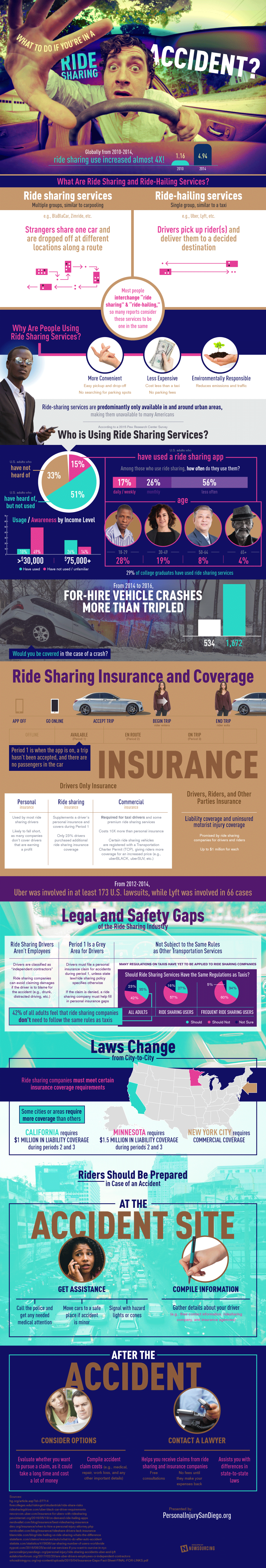

From 2010-2014, ride sharing use worldwide has increased close to 4X!

- 2010: 1.16 million

- 2014: 4.94 million

- What Are Ride Sharing and Ride-Hailing Services?

- Ride sharing companies connect regular drivers to people that need a lift

- Ride sharing services (e.g. BlaBlaCar, Zimride, etc.)

- Multiple groups, similar to carpooling

- Strangers share one car and are dropped off at different locations along a route

- Ride-hailing services (e.g. Uber, Lyft, etc.)

- Single group, similar to a taxi

- Drivers pick up rider(s) and deliver them to a decided destination

- Ride sharing services (e.g. BlaBlaCar, Zimride, etc.)

- Ride sharing companies connect regular drivers to people that need a lift

Most people interchange ride sharing and ride-hailing, so many reports consider these services to be one in the same

- Why Are People Using Ride Sharing Services?

- More Convenient

- Easy pickup and drop-off

- No searching for parking spots

- Less Expensive

- Cost less than a taxi

- No parking fees

- Environmentally Responsible

- Reduces emissions and traffic

- More Convenient

Ride-sharing services are predominantly only available in and around urban areas, making them unavailable to many Americans

- Who is Using Ride Sharing Services?

- Only 15% of American adults

- Weekly: 14%

- Daily: 3%

- Age

- 18-29: 28%

- 30-49: 19%

- 50-64: 8%

- 65+: 4%

- Income

- $75,000+: 26%

- $30,000-$75,000: 13%

- $30,000 and less: 10%

- Only 15% of American adults

From 2014 to 2016, for-hire vehicles crashes more than tripled increasing from 534 to 1,672!

- Would you be covered in the case of a crash?

- Ride Sharing Insurance and Coverage

Period 1 is when the app is on, a trip hasn’t been accepted, and there are no passengers in the car

- Drivers Only

- Personal insurance

- Used by most ride sharing drivers

- Likely to fall short, as many companies don’t cover drivers that are earning a profit

- Ride sharing insurance

- Supplements a driver’s personal insurance and covers during Period 1

- Only 23% drivers purchased additional ride sharing insurance coverage

- Commercial insurance

- Typically used by taxi drivers and available for ride sharing drivers

- But costs 10X more than personal insurance

- Drivers, Riders, and Other Parties

- Liability coverage and uninsured motorist injury coverage

- Promised by ride sharing companies for drivers and riders

- Up to $1 million for each

- Liability coverage and uninsured motorist injury coverage

- Personal insurance

From 2012-2014, Uber was involved in at least 173 U.S. lawsuits, while Lyft was involved in 66 cases

- Legal and Safety Gaps of the Ride Sharing Industry

- Ride Sharing Drivers Aren’t Employees

- Drivers are classified as “independent contractors”

- Ride sharing companies can avoid claiming damages if the driver is to blame for the accident (e.g. drunk, distracted driving, etc.)

- Period 1 Is a Grey Area for Drivers

- Drivers must file a personal insurance claim for accidents during period 1, unless state law/ride sharing policy specifies otherwise

- If the claim is denied, a ride sharing company must help fill in personal insurance gaps

- Not Subject to the Same Rules as Other Transportation Services

- Many regulations on taxis have yet to be applied to ride sharing companies

- Should Ride Sharing Services Have the Same Regulations as Taxis?

- 42% of all adults feel that ride sharing companies don’t need to follow the same rules as taxis

- Laws Change from City-to-City

- Ride sharing companies must meet certain insurance coverage requirements

- Some cities or areas require more coverage than others

- Minnesota: $1.5 million in coverage during periods 2 and 3

- California: $1 million in liability coverage during periods 2 and 3

- New York City: Requires commercial coverage

- Ride Sharing Drivers Aren’t Employees

- Riders Should Be Prepared in Case of an Accident

- Accident Site

- Get Assistance

- Call the police and get any needed medical attention

- Move cars to a safe place if accident is minor

- Signal with hazard lights or cones

- Compile Information

- Gather details about your driver (e.g., their contact information, ridesharing company, and insurance agencies)

- After the Accident

- Consider Options

- Evaluate whether you want to pursue a claim, as it could take a long time and cost a lot of money

- Compile accident claim costs (e.g., medical, repair, work loss, and any other important details)

- Contact a Lawyer

- Helps you receive claims from ride sharing and insurance companies

- Free consultations

- No fees until they make your expenses back

- Assists you with differences in state-to-state laws

- Helps you receive claims from ride sharing and insurance companies

- Consider Options

- Get Assistance

- Accident Site